The 2008-2009 global financial crisis led to a number of large–scale government interventions across the world. These included massive provisions of liquidity, the takeover of weak financial institutions, the extension of deposit insurance schemes, purchases by the government of troubled assets, bank recapitalization and, of course, packages of fiscal stimulus, sometimes of a scale not seen since World War II. Even the IMF, the world’s traditional guardian of sound public finance, came out strongly in favor of fiscal loosening, arguing through its managing director that “if there has ever been a time in modern economic history when fiscal policy and a fiscal stimulus should be used, it’s now” and that it should take place “everywhere where it’s possible. Everywhere where you have some room concerning debt sustainability. Everywhere where inflation is low enough not to risk having some kind of return of inflation, this effort has to be made.”

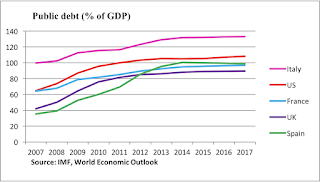

One can argue whether the responses to the crisis were well-designed in particular countries, but there seems to be broad consensus that rapid international action on a number of fronts was necessary to prevent a 1930s-like depression with unforeseen global economic consequences. In the years that followed, public-debt levels rose rapidly, particularly among the advanced economies. Spain, for instance, saw its debt levels rise from under 37% of GDP in 2007 (well within the Maastricht criteria) to about 100% of GDP in 2014, according to IMF estimates.

Indeed, in many countries public indebtedness today stands at levels last seen at the end of World War II. These fiscal developments, however, have not prevented the emergence of an intense debate, particularly in Europe but also in the United States and other OECD countries, about the desirability of continued fiscal loosening, to mitigate the effects of weak economic growth and high levels of unemployment. These debates—largely academic at first—have intensified recently and have had political spillovers in some countries, with resigning ministers arguing against the constraints of “austerity,” as happened recently in France.

I would like to argue that this debate is largely a false one, in the sense that many countries, in fact, do not have the luxury of entering into a prolonged period of fiscal expansion, in the hopes of revitalizing anemic growth rates. Some form of fiscal consolidation, supported by other structural and institutional reforms, may be the only viable path in coming years. Here are three arguments in support of this claim.

- Reduced fiscal space. Many countries currently “suffering” the rigors of austerity face a sobering fiscal arithmetic over the next several years. To take an example: in 2013 Spain had a total financing need in excess of 20 percent of GDP. About two thirds of this consisted of maturing public debt and the rest was explained by a persistent budget deficit. The fiscal authorities, therefore, needed to access the bond markets on an annual basis to the tune of close to $300 billion (the financing figures for this year are broadly similar). This level of funding can be manageable in the context of a growing global economy with bullish investors and confident consumers. It becomes a huge risk if investors decide that the debt burden is unsustainable. In that scenario, interest rates will rise (sometimes with amazing speed) and the ability of the government to fund itself at reasonable cost will suddenly evaporate. With high debt levels, the room for fiscal maneuver is constrained by the mood of the international bond markets. To argue against austerity is fine, provided the authorities are certain that they will not lose the confidence of the markets in the process. With debt levels hovering around 100% of GDP that certainty is simply not there. Not only are governments constrained in a fiscal stimulus, but with rising debt levels a growing share of spending will have to go to debt service, limiting expenditures on education, infrastructure and health and other areas that will improve competitiveness. Furthermore, not being a captive of the markets, means policymakers can be proactive about reforms, rather than reactive to a changing external environment.

- Medium-term pressures. One line of thinking argues that we should not worry excessively about debt levels now. In the United Kingdom and the United States, for instance, debt levels at the end of World War II were well in excess of 100% of GDP (in the UK substantially so). A combination of relatively good fiscal management, some inflation, and economic growth brought these levels down significantly by the mid-1970s. The problem with this argument is that the decades following the war had very favorable demographics, with substantial increases in the working age populations. Today we have the opposite problem: ageing populations. The cost of pensions, healthcare, and other social benefits is projected to rise rapidly over the next several decades. In the United States, for instance, 78 million people were born between 1946 and 1964 (the “baby boomers”) and this cohort started retiring in 2011. And this is not a problem only in rich industrial countries. China, Russia, Poland, Indonesia, Turkey, Mexico, to name a few, have an ageing population of their own. So, in coming years and decades, there will be fiscal pressures that were not present in the late 1940s and 1950s and that will significantly add to budgetary burdens and erode the ability of governments to simply “grow out of debt.”

- Unstable financial markets. There are credible economists (Nobel laureates even) who argue that the global financial system is inherently unstable, that there is no guarantee that it will not crash in the future as a result of abuse, misbehavior or other factors unrelated to those which caused the last crisis. Robert Shiller (2009), a leading observer of financial markets and one who issued repeated warnings about the real estate bubble in the United States, thinks that “capitalist economies, left to their own devices, without the balancing of governments, are essentially unstable.” There is no certainty, thus, that we could not yet again face what we saw in 2008 following the collapse of Lehman, or some variant thereof. What makes this a nightmare scenario is that the ability of governments to prevent an economic depression through a variety of interventions, such as those deployed in 2008-2009, will be very much a function of the health of their own finances. Absent this, what is left is the Latin American scenario of the 1980s: debt default and potentially very high inflation, except that this time around the impact would be global and highly destabilizing. The point here is that another financial crisis could put exactly the same kinds of pressures on budgets that we saw after 2008, but now the starting point, in terms of debt levels, is much worse.

It is misguided to think that if we could only relax budget rules and allow bigger deficits and correspondingly higher levels of debt, this will eliminate the need for the painful and long delayed reforms that highly indebted countries so desperately need. France, a member of the G7 and one of the world’s larger economies, has been running budget deficits without interruption for the past 40 consecutive years. In good times and bad times. Under conservative governments, and left-leaning ones. Along the way, public debt has more than quadrupled from under 21% of GDP in 1980 to close to 97% of GDP in 2014. To argue that, now, with weak economic growth, the solution is to be found in yet another episode of fiscal loosening is to profoundly misdiagnose the cause for the sluggish growth. Sustainable economic recovery—essential to successfully address the debt problem—will only come when governments implement reforms that will help remove supply-side barriers that have long undermined competitiveness and reduced potential growth. If anything, the global financial crisis has shown the high costs associated with delayed reforms.