In a previous blog we discussed the factors that have pushed issues of corruption to the centre of policy debates about sound economic management. A related question deals with the sources of corruption: where does it come from, what are the factors that have nourished it and turned it into such a powerful impediment to sustainable economic development? Economists seem to agree that an important source of corruption stems from the distributional attributes of the state. For better or for worse, the role of the state in the economy has expanded in a major way over the past century. In 1913 the 13 largest economies in the world, accounting for the bulk of global economic output, had an average expenditure ratio in relation to GDP of around 12%. This ratio had risen to 43% by 1990, with many countries’ ratios well in excess of 50%. This rise was associated with the proliferation of benefits under state control and also in the various ways in which the state imposes costs on society. While a larger state need not necessarily be associated with higher levels of corruption—the Nordic countries illustrate this—it is the case that the larger the number of interactions between officials and private citizens, the larger the number of opportunities in which the latter may wish to illegally pay for benefits to which they are not entitled, or avoid responsibilities or costs for which they bear an obligation.

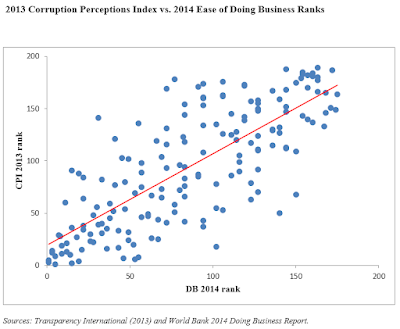

Governing often translates into the issuing of licenses and permits. From the cradle to the grave, the average citizen has to enter into transactions with some government office or bureaucrat to obtain a birth certificate, to get a passport, to pay taxes, to open up a new business, to drive a car, to register property, to engage in foreign trade, to sell a good or service to the government, to hire an employee, to be allowed to build a house, among countless others. The World Bank’s Doing Business Report has become a useful annual compendium of the burdens of business regulation in 189 countries. The picture that emerges from the report for a large number of countries is a sobering one. Go to the report’s website and see why in so many parts of the world businesses endure numbing levels of bureaucracy and red tape. In fact, the data in the report eloquently highlights the extent to which many governments discourage the development of entrepreneurship in their own private sectors. Not surprisingly, the prevalence of corruption is highly correlated with the incidence of red tape and excessive regulation. The figure below shows the country rankings for Transparency International’s latest Corruption Perceptions Index and the rankings for DB 2014 for a total of 175 countries. The figure speaks for itself: the greater the extent of bureaucracy and red tape, the greater the incidence of corruption—the correlation coefficient is close to 0.80.

A number of surveys have shown that businesses allocate considerable time and resources to dealing with red tape. Often, they may feel that the paying of bribes is a way to save time and enhance efficiency and, in many countries, possibly the only way to get business done without undermining the firm’s competitive position vis-à-vis those who pay bribes routinely. Obviously, the more dysfunctional the economic and legal system and the more onerous the regulations, the greater the incentives for individuals and businesses to short-circuit it through the paying of bribes. The literature is full of examples: the absurdities of central planning in the Soviet Union induced “corruption” on the part of the factory managers, to add a degree of flexibility to a system that made a mockery of efficiency in resource allocation. The more insane the rules, the more likely will participants in the system find themselves breaking them.

Leff, a Harvard researcher argued in an insightful analysis in 1964 that those who viewed corruption as an unremittingly bad thing were implicitly assuming that governments were well-motivated and committed to the implementation of policies that advanced the cause of economic development. In reality, Leff thought that in many countries policies were largely geared to advancing the interests of the ruling elite. Leff and Nye (a Harvard colleague) both suggested that corruption was partly a response to market distortions, to red tape, excessive and unreasonable regulation and bad policies but these, in turn, were also themselves affected by the levels of corruption prevailing in the country, in a symbiotic two-way form of causality that turned corruption into an intractable social and economic problem. While it is clear that bribes and corruption may in some cases be responses to the existence of distortions in the economy, we will see in a future blog that far from enhancing efficiency, corruption imposes heavy costs on society, across a broad range of fronts.

The tax system itself is often a source of corruption, particularly in those cases where the underlying legislation is unclear or otherwise difficult to understand, presumably giving tax inspectors and auditors considerable leeway in interpretation. Unclear tax laws will give rise to unwholesome “compromises” between tax inspectors and taxpayers. More generally, there are numerous ways in which various features of government organization and policy create incentives for the emergence of corrupt behavior. As noted above, the imposing presence of the state in the economy and, in particular, the provision of goods and services at below market prices create fertile ground for corruption. Invariably, they give rise to the creation of some form of rationing mechanism to manage excess demand, requiring the exercise of discretion on the part of some government official(s). I remember a meeting at the Central Bank of Russia in May of 1992 in which we were shown an annex running into several pages with the exchange rates that applied for the importation of various items, from luxury cars, to medications to baby carriages. Some bureaucrats had managed to come up with some mysterious criteria establishing dozens upon dozens of prices for foreign exchange, depending on the item to be imported. Needless to say, the list allowed considerable latitude for discretion.

A similar regime existed for export quotas, allowing those who obtained an export license to benefit from the huge gap between the domestic price and the international price. Another legacy of the Soviet Union was a system of directed credits, essentially highly subsidized loans to agriculture and industry. At rates of interest that were absurdly negative in real terms, the demand for them was unusually strong and, of course, the criteria for allocation opaque in the extreme.

While it is easy to see the incentives for bribes provided by such examples, the resulting losses in economic efficiency are likewise evident. Directed credits in Russia did not generally end up with farmers. Rather they ended up with the highest bidder who then used the proceeds to buy foreign exchange and finance capital flight (the credits themselves were never paid back or were paid in deeply depreciated rubles). Export quotas resulted in massive losses for the Russian budget, at a time when the country was going through a severe economic contraction and when, therefore, there were enormous pressures for increased social spending. Susan Rose-Ackerman, one of the leading experts on corruption, calls the above kind of bribery, bribes that clear the market or that equate supply and demand.

Some bribes are offered as incentive payments for bureaucrats. These can take a variety of forms, such as “speed money,” ubiquitous in many parts of the world, and typically used to “facilitate” some transaction, to jump the queue, and so on. Some economists have argued that this could improve efficiency since incentives are provided to work more quickly and those who value their time highly can move faster. Gunnar Myrdal (1968), however, has pointed out that, over time, incentives could work the other way: bureaucrats will deliberately slow things down or, worse, will find imaginary obstacles or themselves create new obstacles, in order to attract facilitation fees. So, in the end, “speed money” is not paid to speed things up but rather to avoid delays artificially created by corrupt bureaucrats. Indeed, some of the regulations enforced in many parts of the world are so devoid of rationality that one can only infer that they were introduced to create opportunities for bribery. Far from being a way to enhance efficiency, paying bribes preserves and strengthens the bribery machinery. This is a vast subject. The reader can find many more examples here. In our next blog we will turn our attention to the issue of the various consequences or effects of corruption.